Get instant loan offer suitable to your profile !

On this Page:

Learn about the Tata Capital education loan application process with a step-by-step process with important tips for a smooth loan application process.

If you have finalised taking your education loan from Tata Capital, then this article is going to be very helpful to you. We will discuss the Tata Capital education loan application process in a step-by-step manner. The entire application process has been divided into 7 simple steps. Before we proceed with the application process, please make sure that you meet the following eligibility criteria for the Tata Capital education loan.

It is very important that you meet the eligibility criteria set by Tata Capital for its education loan. The following are the most important eligibility criteria:

| Category | Details |

|---|---|

|

Nationality |

Indian |

|

Age |

18 to 35 years |

|

Qualification |

10+2 or diploma |

|

To pursue course |

Graduation/Postgraduate degree or a PG diploma in professional education |

|

University applied to |

Listed, recognized, and accredited institutes in India and abroad |

|

Pre-requisites |

|

|

Loan amount |

|

|

Co-borrower |

Father, mother, brother, sister, spouse (husband/wife), grandparents, parents-in-law, maternal/paternal uncle |

|

Security (If going for a secured education loan) |

Residential or commercial property, fixed deposit |

Always make sure that your loan requirement estimates are as accurate as possible. Include tuition fees, accommodation, books, travel (if abroad), and other living expenses. Missing out on any of these expenditures can put a strain on your financial conditions. All these expenses are covered by many education loans and Tata Capital education loan covers all of these education expenses, depending on your profile and the course.

Now, let us explore the Tata Capital education loan application process by online method. We recommend that you submit your application by online method which is more convenient and saves a lot of your time.

However, if you further want to save time, and get better interest rates and faster loan processing, all you need to do is check your loan eligibility at GyanDhan. One of our education loan counsellor will get in touch with you with dedicated support from application till approval of your education loan, and you do not have to pay us anything.

Step 1: Visit the official page of Tata Capital.

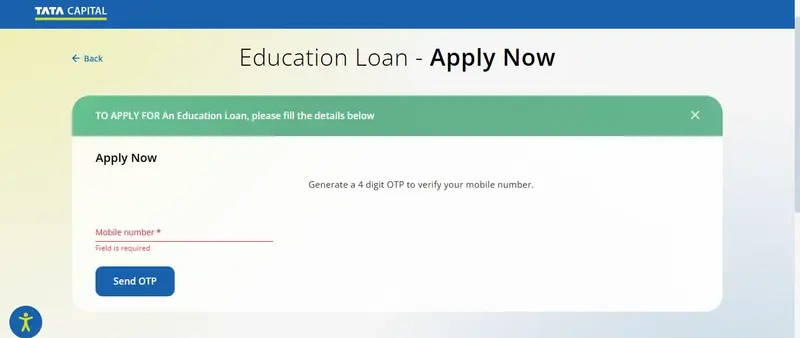

Step 2: Enter the details and click on “Apply”

Step 3: An OTP will be sent to verify your number, enter it and click on “Submit”

Step 4: A confirmation will be sent to you with your application ID.

Step 5: Document Submission

Step 6: Verification and Processing

Step 7: Loan Approval and Sanction Letter

Please note that you have a limited time to sign the sanction letter, post that time, you have to re-do the entire loan application process.

Step 8: Loan Disbursement

If you are planning to apply for a Tata Capital education loan offline, then you need to take the following steps:

Please note that the Tata Capital education loan application process by online method is always convenient and time-saving.

The following are important tips that can help you with your education loan process:

Getting an education loan from Tata Capital is a simple process if you follow the right steps. Whether you are planning to study in India or abroad, Tata Capital can help you with your education loan with complete coverage.

If you can pledge collateral, then you can get up to INR 2 crores as an education loan, however, without collateral, you can get up to INR 85 lakhs.

For amounts up to INR 85 lakhs, you do not need to provide collateral, however, if your requirement is above INR 85 lakhs, then you have to provide collateral.

Father, mother, brother, sister, spouse (husband/wife), grandparents, parents-in-law, maternal/paternal uncle can be your co-applicant for the Tata Capital education loan.

Once all documents are submitted, Tata Capital typically processes education loans within a 7-10 working days, depending on your profile, loan requirements and loan type (secured or unsecured).

You can begin the enquiry process, but final loan approval requires an admission letter from a recognized institution.

Check Your Education Loan Eligibility

Ask from a community of 10K+ peers, alumni and experts

Trending Blogs

Similar Blogs

Network with a community of curious students, just like you

Join our community to make connections, find answers and future roommates.. Join our CommunityCountry-Wise Loans